Married Tax Brackets 2025. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. For tax year 2025, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%.

Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

For tax year 2025, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%.

2025 Married Filing Jointly Brackets Addy Lizzie, The federal income tax has seven tax rates in 2025: $383,900 is the maximum threshold for the 24% federal marginal income tax bracket,.

2025 Irs Tax Brackets Married Filing Jointly Single Hilda Larissa, If your income hasn't kept pace with inflation this year, you may soon get some financial relief in the form of a tax cut. Tax experts are divided on the ideal tax income tax slabs and income tax rates under the new tax regime.

Tax Brackets 2025 Vs 2025 Married Filing Ellen Michele, In this calculator field, enter your total 2025 household income before taxes. Finance minister nirmala sitharaman is.

2025 Tax Brackets Married Jointly Quinn Carmelia, $383,900 is the maximum threshold for the 24% federal marginal income tax bracket,. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Married Tax Brackets Aeriel Valencia, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Tax Brackets Married Filing Jointly With Partner Kare Kessiah, The income tax calculator estimates the refund or potential owed amount on a federal tax return. Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married.

Irs Tax Brackets 2025 Married Jointly Daron Ronnica, Include wages, tips, commission, income earned from interest, dividends,. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

IRS Sets 2025 Tax Brackets with Inflation Adjustments, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Irs Tax Bracket Married Filing Jointly 2025 Carlen Kathleen, The federal income tax has seven tax rates in 2025: As your income goes up, the tax rate on the next layer of income is higher.

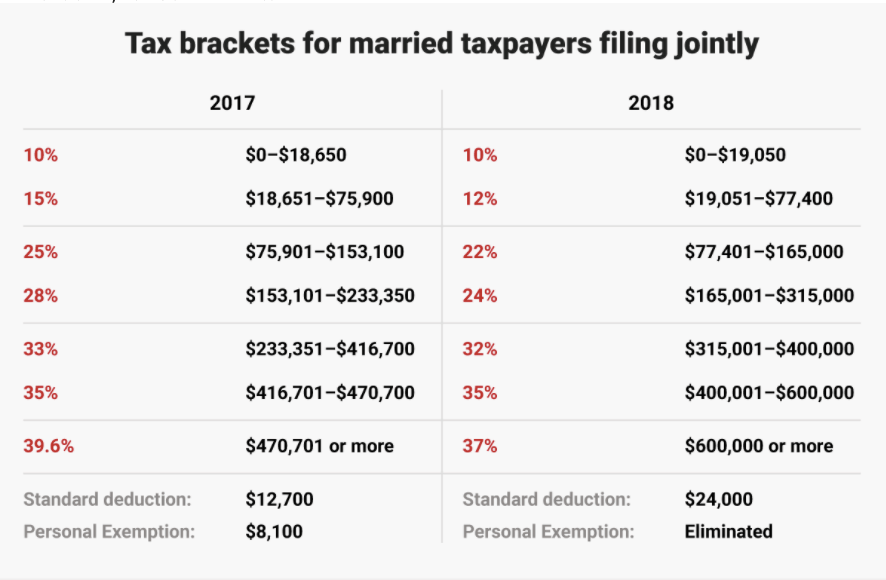

Tax Brackets 2025 Married Jointly Over 65 Ardith Mozelle, 10 percent tax liability will be levied on income up to rs 10 lakh instead of only rs 9 lakh. While the tax rates are identical for 2025 and 2025, the irs increased the income thresholds that determine your bracket by about 5.4% for 2025.